Does sustainability matter to you?

Climate change, extreme poverty, species extinction: what can your savings do to help solve these challenges? At MyFairMoney, we believe that the way each of us invests our money can be a part of the solution. We are a free, independent, non-profit platform helping you to take sustainability into account, and invest in line with your values.

WHAT IS MYFAIRMONEY?

We offer tools and resources to help to invest your savings more sustainably.

- Extensive information on sustainable finance

- An online-questionnaire will help you identify your sustainability profile,

- A European fund database to help you check your current investments or find new investments that match your sustainability profile.

- Resources to prepare you for your next financial advice meeting

It's all free and as a non-profit think tank, we serve only the public good and have no commercial interests.

WHAT IS SUSTAINABLE INVESTING?

When an investment takes into account Environmental, Social, and/or corporate Governance (ESG) issues, it is considered a Sustainable investment. ESG is the acronym used to designate this range of issues. A growing number of investment products take ESG criteria into account (funds, bonds, direct investments, etc...).

There is a whole range of sustainability issues and then again several strategies on how to take them into account. Therefore, it is important that you know your products well and can ensure that they are really in line with your values. MyFairMoney aims to help with exactly that.

Getting started with sustainable investments

Knowledge Hub

Many people in Europe are interested in sustainable investing but feel they lack the information and time to get started. MyFairMoney’s Knowledge Hub is here to help! Explore interactive videos on sustainable finance basics, short podcasts about the impact of your savings, and a documentary with simple steps to make your money fight climate change. With these resources, it’s easier than ever to learn and take action toward sustainable investing!

Learn the most important basics about sustainable finance in less than 40min! This section offers videos and quiz questions to make sure you've memorized the most important learnings. Why not start today?

1. Introduction to sustainable finance

2. Understand your financial and sustainability motivations

3. It’s getting real! Your first steps in making your savings more sustainable.

4. Sustainability strategies for your investment

5. How to maximize the impact of your savings

6. What is the EU Taxonomy?

7. Sustainability preferences and your financial advice meeting

This podcast series helps you to increase the impact of your savings. If you’re a retail investor who wants to make a positive difference with your money, you’ve come to the right place!

1. Introduction to impact investing

2. Impact of sustainable investing

3. Best financial products to have an impact

4. Impact VS sacrificing return...or increasing risk

5. “Green” financial products and their climate impact

6. Impact-washing

7. Investor stewardship

8. Wrapping up the series

The global economy needs $3-5 trillion annually to limit warming to 1.5°C, but less than half is being invested. With state budgets stretched, private capital and better financial flows are essential. Many unknowingly fund fossil fuels through their savings, while sustainable oriented investors face greenwashing and poor financial advice. This film explains three simple steps for all those who want their money to have a positive impact on the climate:

1. Change your bank

2. Change your fund manager

3. Invest in high impact products

What’s next? Don’t worry, MyFairMoney has you covered! Our impact database features impactful savings accounts and other high-impact products. If you’re looking for fund managers with credible climate stewardship, you can find the best-performing asset managers (from the 30 largest globally) in our fund database. Why not take action today?

Discover your sustainability profile

Questionnaire

Usually, conversations with your financial advisor are focused on financial matters only. However, from August 2022 on it will be mandatory for investments advisors to take into account their customers' sustainability preferences. This questionnaire will help you think about your sustainability goals and preferences. You can use the questionnaire, and prepare your next meeting with your financial advisor.

Access the questionnaireBefore giving investment advice, advisors need to collect information from their clients about :

- Their knowledge and experience with financial products

- Their risk aversion

- Their ability to bear losses

- Their investment objectives.

- Their sustainability preferences

In August 2022, the EU Commission made it mandatory that financial advisors also ask about the sustainability preferences of their clients, on topics like the environment, social issues or corporate governance. For this reason, we created a sustainability questionnaire that will help you think about your sustainability goals and preferences and present them to your advisor. The results are made available as a PDF.

Researchers identified three main categories of investor goals when it comes to sustainable investing. What kind of investor are you?

- Risk and Opportunities focused investor: Interested in mitigating financial risks, and taking advantage of new opportunities to profit from an ESG investment ?

- Value-focused investor: Interested in aligning your investments with your moral, political or religious values, by avoiding certain sectors or activities ?

- Impact focused investor: Wishing to have an impact with your investments on the real economy and ESG-related issues?

Use your questionnaire to clarify your ideas and discover which category you belong to. It will help you minimize the risk that your investments are not in line with your values and objectives.

How sustainable is your fund?

Fund database

The fund database with around 17,000 European funds can perform several tasks for you: You can use more than 30 filter options (e.g. based on your sustainability profile) to identify funds that match all or some of your non-financial preferences. With the help of the search functionality, you can also find more detailed ESG information about individual funds you are invested in. Note that the fund database is purely for informational purposes and does not provide any investment advise.

Access the fund databaseOur fund database of 17 000 European funds includes more than 30 ESG data points, making it one of the largest non-commercial retail investor databases of its kind.

The filters are mainly based on data from the sustainability rating agency ISS ESG and Asset Impact.

In addition to these filters, the sorting function can be used to display the funds in different orders (by default, funds with the highest Paris Alignment Scores are displayed first). Learn more about the individual data points in the little information buttons or explore our glossary.

If you're searching for a specific fund or if you want to examine a fund more closely, open up the fund profile to display in-depth ESG information.

The SDG Assessment Score shows how well the companies in a fund align with the United Nations Sustainable Development Goals (SDGs). It is calculated as a weighted average of each company’s SDG Solutions Score, reflecting both positive and negative contributions to the SDGs. Scores range from -10 to +10. A higher score means a larger share of the fund is invested in companies that, on average, contribute positively to SDG-related solutions. Learn more about the technical background in the glossary or in our methodological documentation.

Note: This score does not indicate the fund’s real-world impact or whether it causes positive change. Rather, it helps investors who want to align their portfolios with their values by supporting companies that support the SDGs.

The Climate Stewardship Score describes how credibly an asset manager influences companies to bring them into line with the Paris Climate Agreement. This includes, for example, influencing the business model, escalation strategies and voting on climate-related resolutions at shareholder meetings.

Note: This indicator may be suitable for investors who want to achieve impact with their investment and would even be willing to invest in companies that are even harmful to the climate in order to change them through management influence.

Controversial Corporates shares in the fund : This section shows the shares of companies in the fund that are involved in alleged controversial activities. Since funds are often invested in several hundred multinational companies from diverse industries, almost all of them contain "controversial activities". If any of these activities are problematic for you, you can decide to redirect your investment accordingly.

Note: the data on controversial corporate activities are mainly taken from the sustainability rating agency ISS ESG as well as from the climate data provider Asset Impact.

The ESG Performance Score displayed at the bottom of the fund profile is an absolute ESG rating provided by ISS ESG. It ranges from 0 to 100 (100 means "very good"). This score is calculated by aggregating and combining the individual scores of companies of the fund. As multinational companies are only just starting to move towards sustainability, the highest score in the fund database is currently 66/100.

Note: The presentation of these ratings and labels does not constitute a guaranty by MyFairMoney for their quality of accuracy. The different providers of ESG ratings and certificates use different methods, which means that ratings or label requirements can vary greatly between providers. This can mean that a fund is rated very well by one provider while it has a poor rating from another provider.

Some of the sustainability criteria mentioned in the MyFairMoney questionnaire cannot currently be mapped in the fund database due to data availability issues. These include some exclusion criteria, impact targets and information on certain funds' sustainable investment strategies.

The indicators for the negative filters/controversial activities in the fund database were designed to be as strict as possible based on the ISS ESG data. We also included a 0% tolerance level for turnover in the respective controversial company activities. All activities analysed by ISS ESG are considered on MyFairMoney. Different stages of value creation are considered, this can include e.g. services for processing, production or distribution of products.

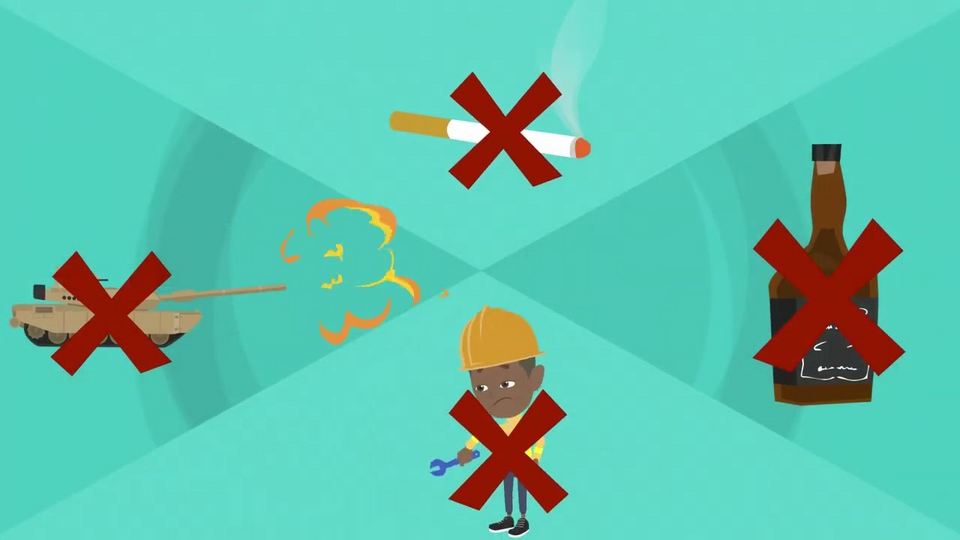

For example, assuming that one company in a fund generates 1% of its sales from the distribution of alcoholic beverages and another company generates 1% of its sales from the production of oxygen masks for the Air Force, then the negative filters/controversial activities "Addictive substances (tobacco, alcohol)" and "Civilian firearms or military equipment" are activated in the database. Fund providers can define a different scope for the exclusion of controversial activities or obtain data on controversial activities from different ESG rating providers. Therefore, it may be worthwhile for private investors to have an open dialogue with fund providers in order to better understand the background of the specified exclusion criteria (e.g. tolerance for turnover thresholds or scope of the covered value chain) and to check whether the definition of the exclusion criteria meets their own expectations.

As the Sustainable Finance Observatory has shown in several analyses, there is insufficient evidence of the impact of financial products on the real economy. However, intermediaries of financial products are responsible for providing this proof of impact if they advertise their products with this promise. Neither the Paris Score, ISS ESG Performance Score, ISS ESG Prime Status nor Fund Rating on MyFairMoney can therefore be used to infer the sustainability impact of a fund.

No investment advice or investment brokerage is provided on this website. No information is requested about the user's risk tolerance, investment behaviour and personal and economic circumstances, nor is any evaluation of these criteria carried out in any form. Investment advice is therefore expressly not provided. The sole purpose of this website is to provide information on the question of the sustainability of various investment funds. The decision to conclude or terminate a contract lies with the retail investor. They should therefore enquire carefully about the costs, opportunities and risks of a product.

The operators of myfairmoney.eu have received the information on the listed investments from the issuer or from third parties. No check has been carried out to ensure that the information provided is correct and up to date. Therefore, no liability is assumed for the correctness, completeness and up-to-dateness of the information provided here. The information shown may be changed or supplemented at any time without prior notice. The operators are not obliged to update or revise the database in any way.

Meeting your advisor soon?

Meeting your advisor

There's no need to feel intimidated by a consultation with your bank or financial advisor. Under "Meeting your advisor," you can use videos and quizzes to learn what's important during the meeting and what you can look out for to ensure that your sustainability goals are taken into account. A checklist also helps you apply what you learned during the meeting or to evaluate your meeting afterwards.

Access "Meeting your advisor"Good preparation will help you ask the right questions, watch out for pitfalls, and get the best results when meeting with your financial advisor. This will involve gathering information about your current financial situation, mapping your future financial goals, and considering your non-financial investing objectives. While it might seem like a lot of effort, it will help you build confidence in investing and better achieve your goals.

In order to evaluate the current state of retail advisory, 2° Investing Initiative carried out roughly 350 undercover client meetings across Europe. As part of this, retail investing clients visited banks, met with advisors, and received advice and product recommendations. In some consultations, the undercover clients made their sustainability goals very clear.

Results: over and over, the consultations were incomplete, too general or failed to consider clients' wider sustainability motivations such as having an impact with their savings. Often, advisors failed to adequately complete client profiles or address their sustainability preferences, and sometimes they even recommended inappropriate products.

This is a warning signal for consumers. They should remember that an advisory meeting is also a sales meeting, at least from the bank's point of view. Sustainability is a compulsory part of these services, however there is an alarmingly low level of regulatory compliance in Europe. This means that retail clients need to be aware of their rights and ask questions in case of doubt.

The "Meeting your advisor" section provides information about financial advisory, answers frequently asked questions, and points out important pitfalls.

If you are dissatisfied with your advice, contact your bank - or, in the case of serious violations, the banking supervisory authority in your country.

If you want to know more

Determine your personal sustainability profile!

Learn more at our fund database